Key Takeaways

- According to California law, insurance carriers must reward good drivers with a 20% discount.

- To qualify, you must have held a driver’s license for three years and maintain a clean driving record.

- Drivers who get more than one demerit point on their records within 36 months are not eligible for the discount.

- You can hide one point from insurance companies by completing traffic school.

- Some insurers also offer discounts for staying accident-free, installing anti-theft systems, and more. Drivers can qualify for multiple discounts at once.

Did you know that you could save at least 20% if you qualify for the California good driver discount? It’s true!

Read on to see if you’re eligible for these savings – and to discover more ways to lower your premiums.

What Is the California Good Driver Discount – and How Do You Qualify?

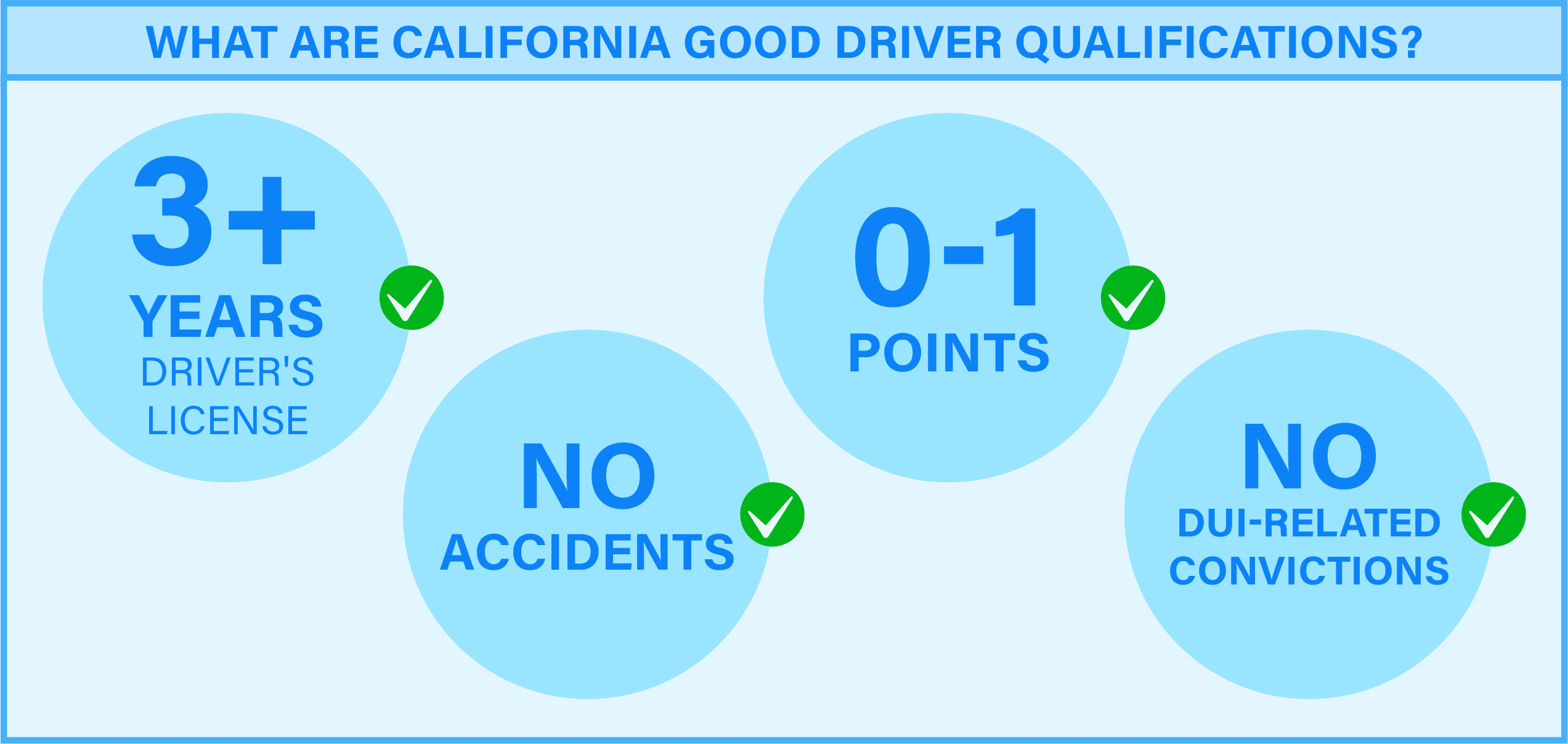

In California, state law requires insurance companies to offer a 20% discount to safe drivers who:

- Have held a driver’s license for three years or longer

- Have had no more than one point on their records in the past three years

- Haven’t been charged with driving misdemeanors or felonies (e.g., DUIs)

- Haven’t been involved in any at-fault accidents that resulted in injury or death

If you meet these requirements, the discount will be automatically applied to your policy. This may result in savings of hundreds or even thousands of dollars, depending on your insurance provider and coverage level.

The California Good Driver Discount Law was part of Proposition 103, which went into effect in 1988. Prior to this reform, auto insurance rates were steadily increasing, placing a financial burden on drivers. As a result, about one in four people in California was uninsured.

Traffic school can help you keep a clean driving record, prevent insurance increases, and more!

What Is Considered a Good Driving Record in California?

The California Department of Insurance states that you’re eligible for a good driver discount if you have no more than one point on your license within the last three years. Therefore, drivers charged with a minor infraction over the past 36 months can still qualify.

For example, a speeding ticket for driving 1 to 25 miles over the limit will add one point to your record.

But if you commit no other offenses within three years, you’ll get a good driver discount. Plus, you can hide that point from auto insurers by completing traffic school.

More serious violations, such as driving under the influence, will automatically disqualify you from the discount. In California, a DUI can be classified as a misdemeanor or felony, and the points will stay on your record for up to 10 years. During that time, you’ll pay higher insurance rates.

At-fault accidents, DUIs, speeding over 100 mph, and other major offenses demonstrate unsafe driving practices. This kind of behavior tells insurance companies that they may have to eventually pay out a claim for you. As a result, they’ll be less inclined to discount your premiums.

How to Check Your Driving Record

Mistakes can happen, and that’s why you should check your California driving record at least once a year, as well as:

- After receiving a traffic ticket

- If you’ve had a car accident

- Before applying for a job where your driving record matters

Simply go to the California DMV website to get a copy of your driving record. Alternatively, request it by mail or from a local DMV office. This service costs $2 to $8, depending on the delivery method and type of record.

By checking your driving record regularly, you can identify and address any errors that could impact your insurance rates. Plus, you’ll know exactly how many points you have accumulated, and whether you qualify for the good driver discount

Can You Lose Your Good Driver Discount?

There are instances where your good driver discount is removed, leading you to pay extra for car insurance. This could happen if:

- You already have one point on your record and get a second one within three years

- You’re charged with a DUI

- You’re found at fault for an accident

- You commit a misdemeanor or felony

In the first scenario, you can mask up to one point on your license by attending traffic school. This option is available to drivers charged with minor moving violations, such as red light camera tickets.

Traffic school won’t remove the ticket from your driving record, but it can help you maintain your safe driver status with your insurance provider. This means that you may get to keep your discount.

The best part? Traffic school can be completed online (way faster than taking an eight-hour traffic school course in person) – and if you choose Best Online Traffic School, you won’t have to pay until after you pass.

Other Good Driver Insurance Discounts

In addition to the California Good Driver Discount, U.S. drivers can qualify for multiple other auto insurance discounts. However, most insurance providers will place a cap on the total discount percentage you can get.

Seniors may also be eligible for government-mandated car insurance discounts. These usually vary between 5% and 20% and may require taking a mature driver safety course.

Here are some of the most common safe driver discounts offered by major carriers. Just make sure you ask your insurance provider about them, as they may not be automatically applied to your policy.

1.) Accident-Free Discount

Many insurers will lower your premiums if you stay accident-free for one to five years. In California, this perk is available to drivers insured by major carriers like:

- Geico

- State Farm

- Progressive

- Nationwide

- Allstate

- Amica

2.) Violation-Free Discount

Most carriers also offer discounts if your driving record stays clean. To qualify, you must go a certain amount of time – typically at least 1-3 years – without getting a traffic ticket for speeding, tailgating, failure to follow a signal, and other minor traffic violations.

Note that some insurers offer this discount on top of the mandatory good driver discount. Others use the term “violation-free discount” for the good driver discount, meaning you must meet the state’s requirements to lower your premiums.

Below are a few examples of insurance companies offering violation-free discounts:

- State Farm

- Progressive

- Nationwide

- Allstate

- Travelers

- Liberty Mutual

3.) Device-Free Driving Discount

Another way you can get a discount on auto insurance? Driving without being distracted by your devices.

Qualifying for this discount often means you need to download an insurance carrier app that will detect whether you pick up or use your mobile device while driving.

A good example is Drivewise, an app developed by Allstate.

Once installed, it monitors your driving behavior, including how often you use your phone behind the wheel. If you prove to be a safe driver, you’ll get discounts and rewards every six months. Check with your insurance provider to see if they have similar technology.

4.) Usage-Based Insurance Discounts

Statistically, people who drive less frequently or for shorter distances are less likely to get into accidents. Less time behind the wheel means lower odds of encountering a dangerous driving situation. Plus, it’s safer to drive in areas where you’re very familiar with the roads.

That’s why some insurance carriers offer usage-based discounts for people who don’t drive very much. These can be based on your vehicle’s mileage, or you can qualify by downloading an app that tracks the time you spend behind the wheel and where you drive.

Here are some companies offering usage-based insurance discounts, including low-mileage discounts:

- State Farm

- Nationwide

- USAA

- Allstate

5.) Equipment-Based Insurance Discounts

Having certain equipment on or in your vehicle makes it safer. That’s why some insurance companies provide drivers with equipment-based discounts for:

- Airbags

- Anti-lock brakes

- Anti-theft or alarm systems

- Passive restraints (seat belts that automatically fasten once the car is turned on)

- Daytime running lights

Since newer vehicles tend to have the latest safety features, some insurance carriers will also offer discounts for driving a newer car.

If you live in California, you may request such discounts from:

- Geico

- State Farm

- Nationwide

- Allstate

- Amica

- Travelers

6.) Defensive Driver Course Discounts

If you’re proactive about staying as safe as possible behind the wheel, your insurance provider may give you a discount on your premiums.

For instance, many carriers offer discounts for customers who take defensive driving courses. These courses can be completed online in just a few hours, which makes them a great investment for anyone looking to save on auto insurance.

Below are some insurance companies that will reward you for completing defensive driver training:

- Geico

- State Farm

- Nationwide

- Amica

- Travelers

If you’re 55+ and have a California driver’s license, check out our DMV-approved Mature Driver Course. It’s accepted by all major insurance carriers and could lower your premiums by up to 15%.

7.) Young Driver Discount

Drivers under the age of 21 to 25 (depending on the insurer) may qualify for additional discounts. Such discounts are available to those who meet one or more of the following requirements:

- Maintain a good driving record

- Take defensive driving classes

- Stay on their parents’ policy

- Move away to school and only drive while at home

For example, Progressive and State Farm have discounts for young drivers who study in a different city or state and drive only when they return home for a visit.

Amica, on the other hand, offers discounts for drivers under 21. The only requirement is to complete a state-approved driver training program. The company also has discounts for full-time students who are away at school, stay on their parents’ policy, and only drive while at home.

8.) Good Student Discount

Young drivers who earn good grades in school (a “B” average or better) may get a discount on their insurance premiums. The savings can be as high as 15%.

One explanation is that good students are more likely to drive safely. Insurance companies want to encourage and reward this behavior.

In California, you could get a good student discount if you’re insured by:

- Geico

- State Farm

- Progressive

- Nationwide

- Allstate

- Travelers

- USAA

- Liberty Mutual

Additional Perks for Good Drivers in California

| California Good Driver Discount | |

| Insurance Provider | Discount Details |

|---|---|

| American Family | Discounts available to drivers with no accidents, traffic violations, or claims within the last 5 years. |

| Allstate | Discounts for low-risk drivers with a clean driving record and those participating in a telematics program (Drivewise). |

| Farmers | Discounts for drivers with zero chargeable accidents or citations for the past 3 years. Additional savings for avoiding at-fault accidents for 5 years. |

| Geico | Save 22% on your car insurance rates by staying accident-free for 5 years. |

| Liberty Mutual | Discounts available for drivers with no traffic violations. |

| Nationwide | Drive safely and maintain a clean driving record for 5+ years to lower your premiums. Use the SmartRide app for further savings. |

| Progressive | Save an average of $231 on auto insurance by driving safely. |

| State Farm | Avoid moving violations and at-fault accidents for three years to receive a good driver discount. Enroll in the Drive Safe & Save program for an extra 10% off. |

The exact amount you can save depends on your age, insurance provider, and other factors. For example, seniors are more likely to qualify for certain auto insurance discounts, such as retired military discounts, than younger drivers.

Our advice is to request multiple quotes from different insurers. Also, ask about the available discounts and what it takes to qualify.

FAQs about Good Driver Discounts

Need more information on auto insurance discounts? Here are the answers to some frequently asked questions.

How long does an accident stay on your license in California?

If you’re involved in a collision while driving a personal vehicle, the accident will stay on your record for three years.

Any collisions with a commercial vehicle or one transporting hazardous materials will remain on your record for 10 years. The same will happen if you’re involved in a car accident while under the influence.

How long does it take to get a good driver discount in California?

Generally, it takes at least three years to qualify for a California good driver discount. You have to have held your license for three years to qualify for the discount. You must also not accumulate more than one point within a three-year period.

Do good grades lower car insurance premiums?

Good students are perceived as safer drivers than those with poor grades and may qualify for car insurance discounts. However, not all insurance carriers will offer these savings.